Quicken For Mac Lion Alternatives

So you’re a Quicken addict (like me), you use a Mac, and now you’re worried about how to keep that addiction rolling when Mac OS X Lion kills Quicken 2007.

While Moneydance may not feel quite as intuitive as Quicken for Mac at first, it can do pretty much everything the latter can and was actually one of the first ever financial applications on the Mac so it's certainly not lacking in experience. When you start Moneydance, you're offered the chance to import data from Quicken Essentials for Mac or setup a new file or account in the currency of your choice. When you've done so, you navigate Moneydance using the menu bar down the left hand side. It's quite easy to get lost at first amongst all the options available so a good idea to use the Help file. Most importantly, Moneydance supports online banking which is what will convince many users to convert to it from Quicken for Mac.

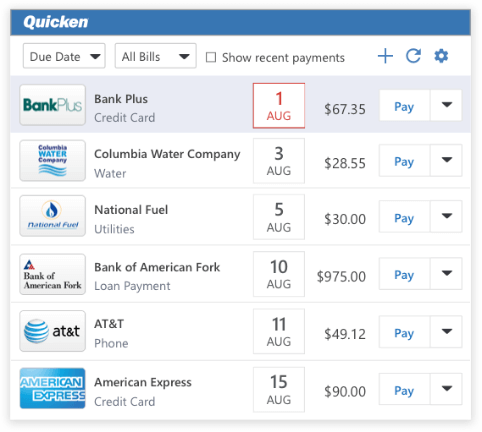

You can retrieve credit card statements and bank statements from most major US banks that support OFX standards. Even better, you can use Moneydance to automatically pay your bills for you too. Moneydance then helps you trace budgets, and reminds you of upcoming bills to keep you up-to-date. There's handy reporting and graphing tools that should give you a little bit more perspective over where your money is going. However, there is no way to upload receipts and other financial documents related to your transactions. Its always useful to have your documents in one place although it depends on whether you scan and file your financial documents regularly. There are some drawbacks to Moneydance.

The handling of split transactions still hasn't been improved from the 2010 version. In addition, the interface can feel a bit complicated and overwhelming at time and this isn't helped by the fact that Moneydance is based on Java which doesn't suit OS X very well.

There's also no support for attaching documents and files such as receipts and invoices which would be useful. Overall, Moneydance maybe isn't quite as good as Quicken for Mac but it does offer a very competitive alternative. Simplify your finances with Moneydance, the groundbreaking personal finance manager! Whether you want to organize your finances, manage your budget, track your portfolio, or just automatically balance your checkbook, Moneydance is the solution for you. Moneydance's simple, intuitive interface makes taking care of your finances a breeze. Save time and money with online banking and bill payment. Moneydance makes it easy to set and trace budgets, and reminds you of upcoming bills to keep you up-to-date.

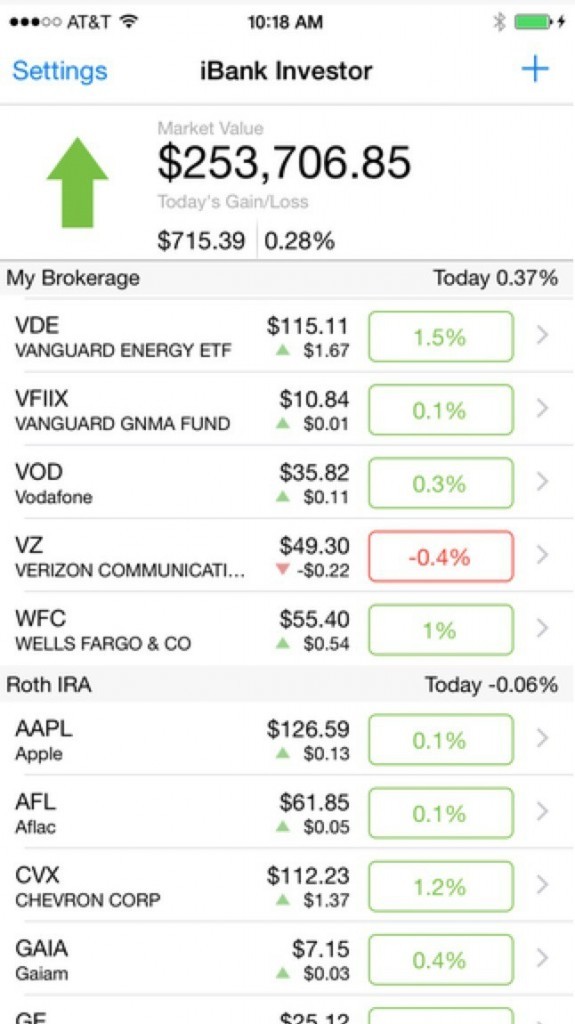

Moneydance's insightful reporting and graphing tools illuminate your finances and show you where your money goes. You can track your portfolio and stay on top of your investments.

MoneyDance also offers encryption and password-protection to ensure your privacy.

• Monitoring alerts, data downloads, and feature updates are available through the end of your membership term. Online services require internet access. Third-party terms and additional fees may apply.

Phone support, online features, and other services vary and are subject to change. 14,500+ participating financial institutions as of October 1, 2018. • Standard message and data rates may apply for sync, e-mail and text alerts. Visit for details. Quicken App is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Not all Quicken desktop features are available in the App. The App is a companion app and will work only with Quicken 2015 and above desktop products.

• Quicken Bill Pay (Bill Payment Services provided by Metavante Payment Services, LLC) is included in Quicken Premier and above and is available on as a separate add-on service in Starter and Deluxe. 15 payments per month included in Premier and above. • Purchase entitles you to Quicken for 1 or 2 years (depending upon length of membership purchased), starting at purchase. Full payment is charged to your card immediately. Amazon audible app for mac. At the end of the membership period, membership will automatically renew every year and you will be charged the then-current price (prices subject to change).